Introduction: The Road to Make1M

Making Make1M might seem like an impossible dream, but with the right strategies, mindset, and financial discipline, it’s an achievable goal. Many people associate wealth with luck, inheritance, or extreme intelligence, but in reality, most self-made millionaires follow a structured path that involves hard work, financial literacy, and long-term planning. The key is not just earning more money but managing and growing it effectively.

To embark on this journey, you need to shift your mindset. Instead of focusing on quick wealth or shortcuts, think about sustainable financial growth. Making Make1M is not just about having a high-paying job or starting a business—it’s about making smart money decisions, investing wisely, and avoiding financial pitfalls. Real-life examples of individuals who reached this milestone show that persistence, calculated risks, and continuous learning play a crucial role in wealth-building.

This guide will take you through different pathways to reaching Make1M, whether through high-income careers, entrepreneurship, investing, or smart financial management. By the end, you will have a clear roadmap to achieving financial success.

Defining Your Make1M Goal

Before you begin your journey to Make1M, you need to define what this milestone means to you. Does it mean earning Make1M in total income, having Make1M in net worth, or accumulating Make1M in investments? Each approach requires different strategies and timelines. Understanding the distinction will help you create a structured plan.

Setting a realistic timeline is essential. If you want to make Make1M in five years, you need to calculate how much you should earn, save, and invest each year. If your goal is to build a Make1M net worth, you must consider factors such as assets, liabilities, and investment returns.

Another crucial aspect is choosing between different wealth-building strategies. You can achieve this goal by excelling in a high-income career, launching a successful business, or making smart investments. Assessing your financial strengths and risk tolerance will help you determine the best path forward.

Lastly, financial literacy plays a significant role in this journey. Understanding budgeting, investing, tax strategies, and wealth management will make a significant difference in how quickly and effectively you reach your goal. Educating yourself about financial concepts will prevent costly mistakes and set you up for long-term success.

Pathways to Making Make1M

A. High-Income Careers & Salary Growth

One of the most straightforward ways to make Make1M is by pursuing a high-income career. Certain industries, such as technology, finance, law, and medicine, offer salaries that make it easier to accumulate wealth. If you choose this path, focus on acquiring valuable skills that are in high demand.

Negotiation skills are also essential. Many employees accept the first salary offer without realizing they can negotiate for better pay and benefits. Increasing your earnings over time through promotions, job changes, and additional certifications can help accelerate your financial growth.

Side hustles can also supplement your income. Many professionals engage in freelance work, consulting, or online businesses to generate extra cash flow. Leveraging multiple income streams increases financial security and speeds up the journey to Make1M.

B. Entrepreneurship & Business Ownership

Starting a business is another powerful way to reach Make1M. Successful entrepreneurs identify problems in the market and create valuable solutions. Whether it’s an online business, a traditional brick-and-mortar store, or a service-based venture, entrepreneurship offers unlimited income potential.

However, running a business requires careful planning, market research, and strategic execution. Scaling a business is crucial for achieving significant revenue. Many entrepreneurs start small, reinvest profits, and expand their operations over time. Having a long-term vision and a willingness to adapt to market trends will determine your success.

Passive income streams, such as e-commerce, digital products, and subscription services, also contribute to financial growth. The key to business success is consistency, innovation, and financial management.

C. Investing for Wealth Creation

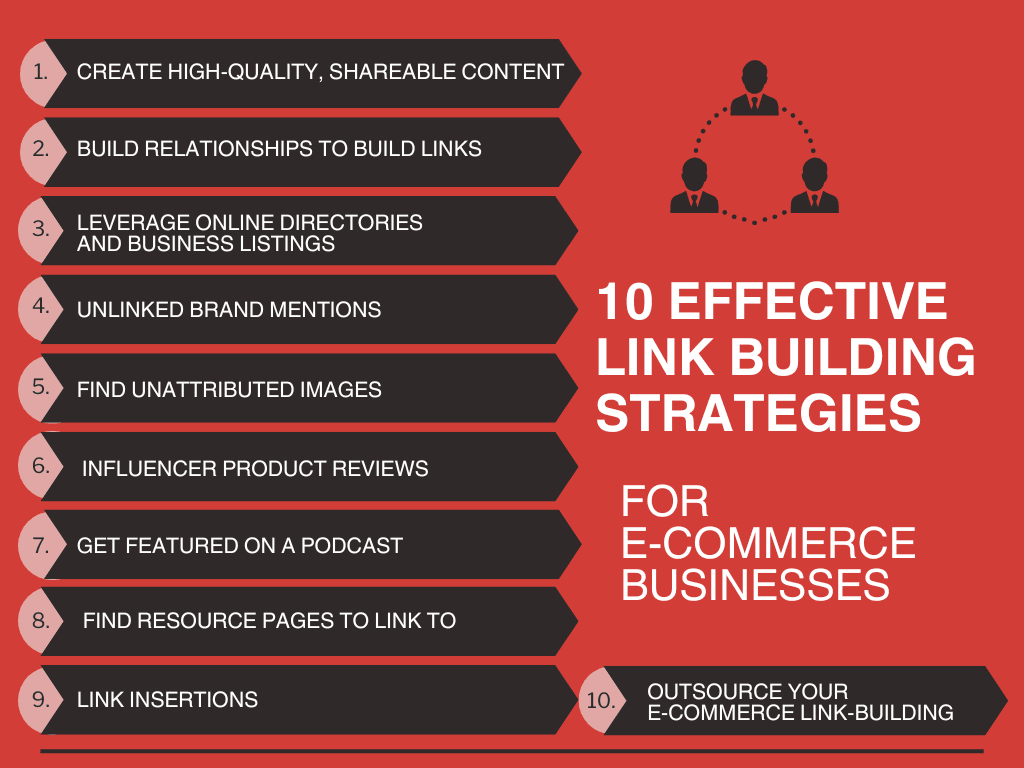

Investing is one of the safest and most sustainable ways to build wealth. The stock market, real estate, and alternative investments offer opportunities to grow your money over time. The power of compound interest allows small investments to multiply into significant wealth.

Stock market investing involves buying shares in companies that appreciate in value over time. Long-term investors focus on diversified portfolios to minimize risk and maximize returns. Real estate investing, such as rental properties and commercial properties, provides both passive income and property appreciation.

Cryptocurrency and alternative investments are also gaining popularity, though they come with higher risks. Diversification is key to balancing high-risk and low-risk investments. Understanding market trends, economic factors, and financial instruments will help you make informed investment decisions.

Smart Money Management & Wealth Retention

Earning Make1M is only part of the equation—managing and retaining it is equally important. Many people make a lot of money but struggle to keep it due to poor financial habits. Budgeting, avoiding unnecessary expenses, and practicing frugality can help preserve wealth.

Lifestyle inflation is a common pitfall. As income increases, many people increase their spending on luxury items and unnecessary expenses. Sticking to a budget and prioritizing savings ensures financial stability.

Tax strategies play a vital role in wealth retention. High earners should take advantage of tax deductions, retirement account contributions, and investment tax benefits to minimize liabilities. Understanding financial laws and consulting professionals can help optimize wealth management.

Building an emergency fund is also crucial. Having savings set aside for unexpected expenses ensures that financial setbacks do not derail your long-term wealth-building efforts.

Overcoming Financial Obstacles & Setbacks

The road to Make1M is not always smooth. Many people face financial setbacks, such as job loss, business failure, or economic downturns. Learning how to recover from these challenges is essential.

Managing debt wisely prevents financial struggles. High-interest debt, such as credit cards and payday loans, can hinder wealth-building efforts. Prioritizing debt repayment and avoiding unnecessary borrowing helps maintain financial health.

Staying motivated is crucial. The journey to financial success requires patience, discipline, and long-term thinking. Surrounding yourself with like-minded individuals, reading personal finance books, and continuously learning will keep you focused on your goal.

Conclusion: Your Journey to Make1M Starts Today

Making Make1M is not about luck—it’s about strategy, discipline, and informed decision-making. Whether you choose a high-income career, start a business, or invest wisely, the key is consistency and financial literacy.

By setting clear goals, managing money effectively, and overcoming obstacles, anyone can achieve financial success. Start your journey today, and take control of your financial future.

FAQs

How long does it take to make $1M?

The timeline depends on income, expenses, and investment strategies. Some achieve it in a few years through high-paying careers, business ventures, or investing, while others take decades.

Is making $1M possible without starting a business?

Yes. Many professionals reach $1M through high-income careers, smart savings, and investments in stocks, real estate, or retirement accounts.

What is the safest way to build wealth?

Investing in diversified assets like stocks, bonds, real estate, and retirement funds minimizes risks while growing wealth steadily over time.

How much should I save and invest to reach $1M?

A common strategy is saving at least 20-50% of income and investing in assets that yield solid returns, like index funds or real estate.

Can I make $1M online?

Yes. Many people earn $1M through e-commerce, digital products, affiliate marketing, freelancing, or content creation.

What mistakes should I avoid when trying to make $1M?

Avoid lifestyle inflation, unnecessary debt, lack of financial planning, and emotional investing. Poor money management can slow progress.

How important is financial literacy in making $1M?

Extremely important. Understanding budgeting, investing, and tax strategies helps maximize wealth-building efforts.